What Is a Personal Financial Statement?

Content

For example, suppose your financial goal is to retire early. You’ve officially paid off your debt , but you’re not sure how close you are to reaching your retirement goals.

- Liabilities are anything that you owe, such as debts, mortgages, and loans.

- This personal balance sheet template will guide you as you are creating your own balance sheet.

- Notate where you can find the information about the current value.

- Record your daily spending with anything that’s handy—a pen and paper, an app or your smartphone, or budgeting spreadsheets or templates found online.

After all, the ultimate goal of this tool is to provide intel to help you make smart financial decisions. Personal finance is about managing your budget and how best to put your money to work to realize your financial independence and goals.

Best Investment Options For Young Adults In India

It’s tempting to let your funds do their own thing and bury your head in the sand, but this can result in your liabilities adding up and getting out of control. Sometimes, looking at the value of your debts or realizing you have a negative net worth is a much-needed wake-up call and helps you take that first step toward paying your loan balances. The red areas are real trouble (credit card debt & the cars). The orange areas are opportunities to shift cash flow around to optimize wealth over time. Subtract the liabilities from the total assets to determine net worth. List the current liabilities that are due within a year of the balance sheet date.

Hopefully your net worth is positive, but it isn’t for everyone, and this is okay. It’s important to remember in personal finance to consider your stage of life. When you are younger, you may be paying off student loans – something that would show up on your balance sheet as a liability but not have a corresponding asset.

What Does Negative Shareholders Equity Mean On Balance Sheet

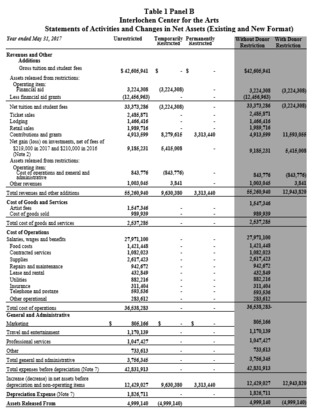

Building a balance sheet is an important practice that must be conducted on either a quarterly or monthly basis. This financial statement provides insight into your company’s financial health by detailing your assets, liabilities, and shareholders’ equity. It lists all of the individual’s assets, such as cash, investments, property, and vehicles, and liabilities, including debts, mortgages, and loans. The personal balance sheet also calculates the individual’s net worth by subtracting liabilities from assets. A balance sheet is the second type of personal financial statement.

- All liabilities should be listed as the amount owed at the present date.

- Meanwhile, if your net worth is consistently going in the opposite direction, that may be a signal that something is wrong.

- Helping you succeed begins with a deeper understanding of your financial picture.

- Personal assets are included on a balance sheet whether they are paid-in-full or not, because the amount that is still owed on the asset will be included as a liability on the balance sheet.

If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice. If a company or organization is privately held by a single owner, then shareholders’ equity will generally be pretty straightforward. If it’s publicly held, this calculation may become more complicated depending on the various types of stock issued. As with assets, these should be both subtotaled and then totaled together. It’s not uncommon for a balance sheet to take a few weeks to prepare after the reporting period has ended. An asset is anything a company owns which holds some amount of quantifiable value, meaning that it could be liquidated and turned to cash. Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

Create Your Personal Balance Sheet

By keeping accurate and up-to-date records, you can make informed decisions about your money and reach your financial goals. Creating a personal balance sheet is a straightforward process that can be done in just a few simple steps. Liabilities are anything that you owe, such as debts, mortgages, https://online-accounting.net/ and loans. These are the obligations that you must pay off over time. Input your assets to a spreadsheet software like Excel or Google Sheets. Group the assets in categories just as you had done earlier on. Input the value of each asset, then calculate the total value of your assets.

Financing sources may also want to assess your personal financial situation to see how well you manage your finances. For instance, if you have few assets and a lot of outstanding debt, it can indicate you might How To Create A Personal Balance Sheet have trouble repaying a loan. If you are in a committed partnership or married and share assets, you and your partner can combine assets and liabilities to create a joint personal financial statement.

To get started, first identify a tool that you can use to track your assets and liabilities. A variety of digital tools are available, including the eMoney Client Portal, which was mentioned inGet Ready, Get Organized and Take Charge.

- A personal balance sheet shows how financially healthy a person is by providing a current overview of the individual’s financial situation.

- For larger businesses, the Balance Sheet is more complicated, and there are more entries to keep track of.

- The tax rules may differ from one retirement account to the next retirement account.

Like you take care of your health, use the balance sheet format to take care of your financial health. The simple format used above can be modified per an individual’s requirements. For instance, Bob might have 5 checking accounts, 5 savings accounts, 3 houses, and 3 cars.

Leave a Reply